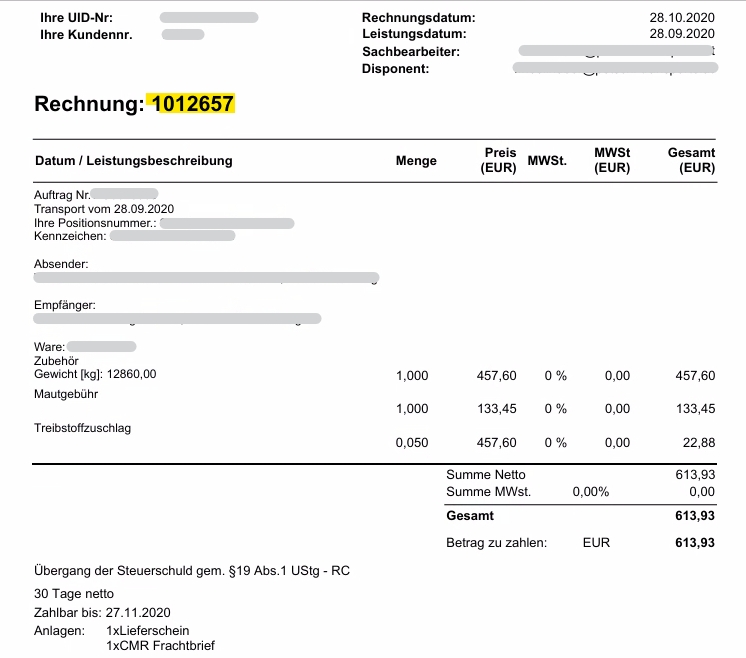

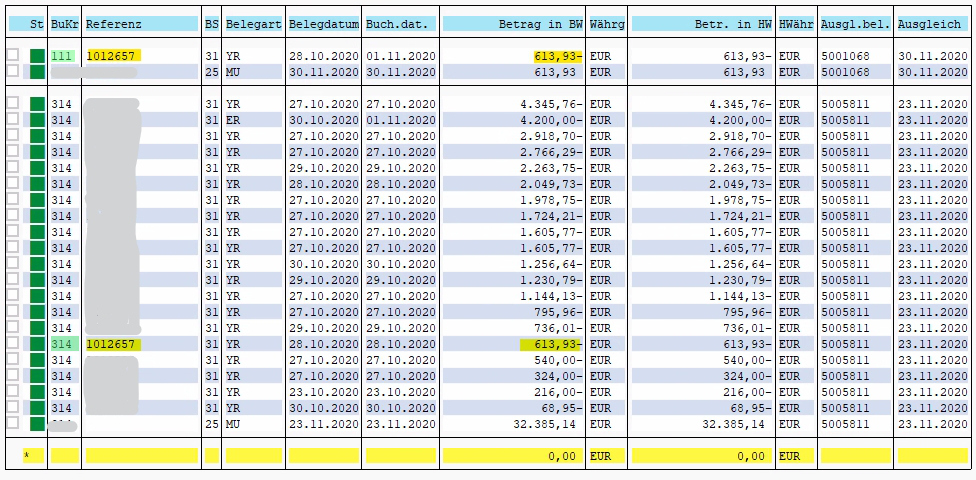

In group accounting, a large number of different company codes for different units or companies, sometimes on different production systems, is part of everyday accounting practice. In the example, the same invoice was posted and paid in two different company codes.

Although the document has identical main parameters (external invoice number, amount, vendor and date), internal validation measures did not recognize this double payment as it was not analyzed across company codes. If different production units have own company codes, the systematic analysis can only be carried out on the basis of defined data deductions, as in this case by EVV GmbH.